finance

Wise 188-890 charge on Truist credit card: You are not alone

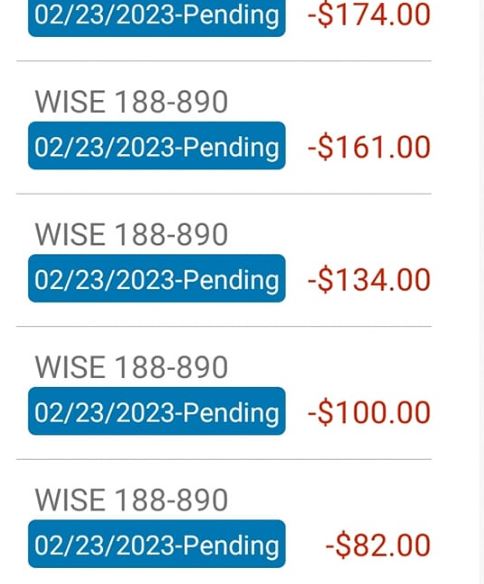

Several reports of suspicious and unauthorized Wise 188-890 charges on Truist credit cards and bank statements have been received from different users.

There have also been reports about this from Charles Schwab bank users. We will be writing a short review about the charge.

Continue reading below to learn more.

Wise 188-890 charge

We spoke with the Truist Business Fraud department, who stated that they had not heard anything directly from Truist about it. It has obviously affected a large number of people in the last 7 days, and Truist has yet to acknowledge the issue.

Be aware that fraudsters frequently conduct a small dollar transaction to see if a card is active before hitting it for a larger sum or they begin selling the numbers on the black market after receiving approval. Minor unauthorized purchases are frequently an indication that the card has been compromised, so you should lock your card right away.

Lots of people on Reddit and Facebook have reported having the Wise 188-890 charge on their credit cards. You can see Here and Here.

“If you bank with truist, need to check your account. I think someone has hacked their system, a lot of people have had transactions from “wise 188-890″ showing up. I had two on mine, totalling $321. I’m thinking it’s time to change banks, this is the third time my account has been hacked with them.” Someone said on Facebook.

What to do if you didn’t authorize the Wise 188-890 charge

If you did not authorize the charge, you could be the victim of credit card fraud. You must immediately notify your card issuer by calling the number on the back of your card or logging into your online credit card account.

Your credit card company will most likely cancel your card and send you a new one. You will not be held liable for the unauthorized charges.

There are several methods for researching unknown credit card charges:

- Look up the words in the description of the charge on your statement using a search engine, exactly as they appear.

- Call the number on the back of your credit card to see if your card issuer has its own merchant search tool.

- Contact any merchants you did business with on the date of the charge and inquire about how their company appears on credit card statements.

With all of the credit card transactions that take place every day, mistakes are unavoidable. However, cardholders have some recourse if errors appear on their credit card bills: you can dispute charges you don’t recognize.

Just keep in mind that the credit card company will investigate the charges, so you should retrace your steps before disputing the charge.

Examine all receipts from that time period to ensure you did not simply overlook a purchase you authorized. If you come up empty-handed, contact the merchant; it could be an honest mistake, and the charge can be reversed. If it’s not an error, contact your credit card company to dispute the charge.

How can I protect myself against unauthorized charges?

Keep copies of your vouchers and ATM receipts so you can cross-reference them with your billing statements. If you suspect unauthorized or fraudulent use of your card, notify your card issuer immediately.

How can I avoid becoming a victim of credit card fraud?

It is impossible to guarantee that you will not become a victim of fraud, but you can reduce your chances by taking the following steps:

• Keep your wallet or purse secure at all times.

• In public, never leave your purse or wallet unattended.

• Never carry all of your cards, only the ones you might need.

• Keep your credit cards separate from your wallet in a credit card case or another compartment in your purse; and

• If your wallet or purse is stolen, contact your credit card issuers right away.

In other news, What’s Quick card san diego charge on credit card?